Is Celsius (CEL) Next To File Bankruptcy After Voyager, Three Arrows

Crypto lender Celsius has paid off another $40.8 million towards its outstanding loan of Maker. The wBTC liquidation price has now dropped to $2,722.11. The beleaguered crypto lender has paid almost $180 million of Maker loan in July.

Meanwhile, the FUD is rising again after Voyager Digital announced that it has filed for Chapter 11 bankruptcy. Also, the Three Arrows Capital and Vauld situation have worsened the sentiments. So, is Celsius next to file for bankruptcy?

Celsius Actively Repays its Outstanding Loan

According to DeFi Explore data, Celsius’ multi-collateral DAI vault 25977 now has an outstanding loan of 41.2 million DAI. The wBTC liquidation price has dropped to $2,722.11 after another $40.8 million loan repayment on July 5. Also, the collateral ratio has jumped over 1000%, with 21,962 WBTC as collateral.

Yesterday, the liquidation price fell to $4966.99 from $11,800 after Celsius repaid almost $120 million for its Maker loan. Other than its Maker loan, the company also has outstanding loans from Compound and AAVE. Although, the data on its loan has not been disclosed by Celsius, around $400 million of debt still exists. Moreover, its exposure to non-DeFi is also unclear.

Voyager Digital today filed for Chapter 11 bankruptcy in the Southern District of New York after its exposure to Three Arrow Capital, which has also filed for bankruptcy. Crypto exchange FTX was unable to rescue Voyager Digital after Three Arrows defaulted on a $660 million loan.

Voyager Digital’s bankruptcy filing and Vauld’s insolvency have spurred fresh fear among the crypto community. Celsius could be next to file for bankruptcy if it fails to pay off the loans.

However, the Celsius liquidation risks appear to be reducing as its collateral stETH slowly repegs with ETH. Celsius has staked customers’ funds as collateral on Lido. However, users claim the company is using their money to pay off its loan.

Simon Dixon, CEO of BnkToTheFuture, in a recent tweet said:

“As I’ve always said. I’m most happy if Celsius Network is liquid and can make depositors hole & put #DepositorsFirst – next shareholders & tokenholders – that involves regulations, trust & plugging financial holes. BankToTheFuture is speaking to Celsius Network to support all 3.”

Users Continue CEL Token Short Squeeze

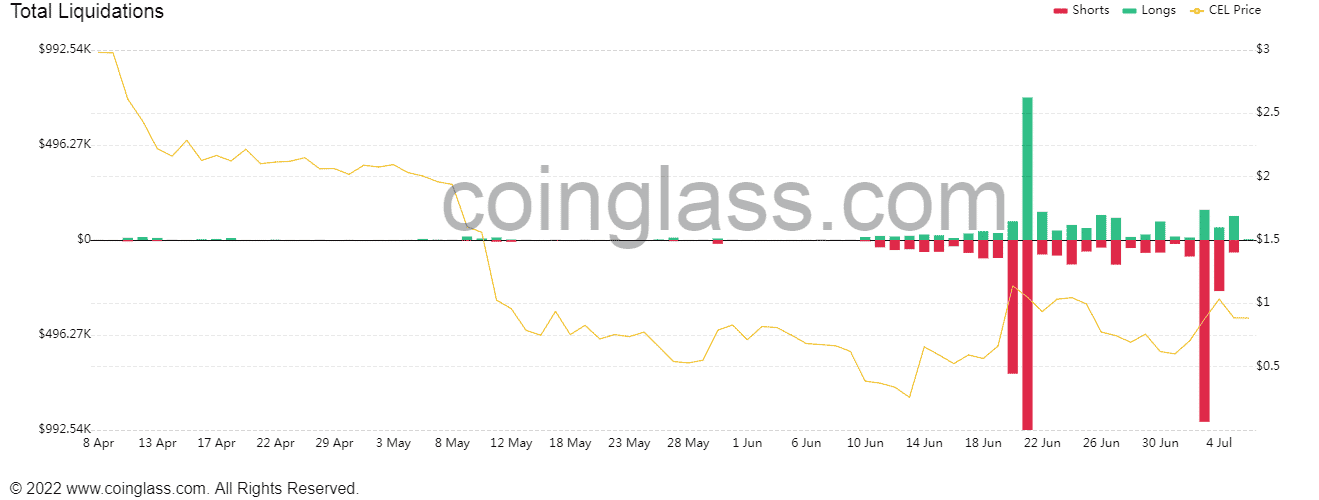

Celsius’ CEL token has soared nearly 80% in July as a result of the short squeeze. The CEL token has seen over $1.5 million in shorts liquidated in the last few days amid short selling, as per Coinglass.

The CEL price is currently trading at $0.90. In the few hours, there are 100% long positions across FTX and Okex exchchanges.

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?