Is Pancakeswap the New Uniswap? Why PancakeSwap Is Surging & What’s Next?

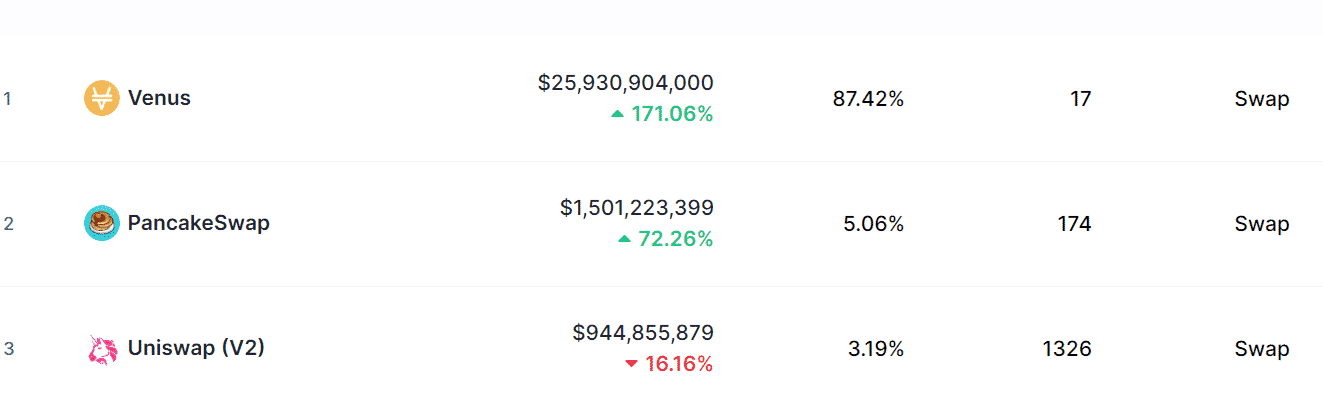

The growing influence of Binance Smart Chain (BSC) amid skyrocketing gas fee on Ethereum network has not just sent Binance Coin (BNB) the native token to the moon, in fact, it has led to significant market flipping in the defi market where Pancakeswap, a BSC based defi protocol has seen greater trading volumes than market leader such as Uniswap.

PancakeSwap, a defi protocol largely unknown prior to the recent BSC craze has seen massive on-chain volumes gaining nearly 72% volume over the past 24 hours itself. The decentralized protocol is only one flipping away from becoming the top defi protocol in terms of volume processed. The rising popularity of Pancakeswap has also led to a massive price boom in the native token CAKE which us up by 63% over the past 24 hours and currently trading at $17.56 and flipped Sushi for a brief period of time.

It's real, @PancakeSwap just flipped $Sushi! pic.twitter.com/Gd7rRE3tXX

— Prodigy (@Prodigy_ETH) February 19, 2021

Defi’s rising popularity is nothing new as its market has grown significantly over the past year and was in contention to be the biggest gainer before Bitcoin broke into a bull run. However, the fact that Defi works on top of the Ethereum network which is currently struggling with a high gas fee, traders have started looking for alternatives, and Binance’s native blockchain BSC seems to be the choice of the majority of the users at the moment looking at its growing market.

Related Link: Pancakeswap (CAKE) Price Prediction – What Will Be The Price Of CAKE In 2021?

Will Binance Lead the Defi Adoption Until ETH 2.0 Goes Live?

The scalability issues with the Ethereum network was one of the key reason behind the development of ETH 2.0, however, the complete roll-out would take nearly 2 years and till then Binance seems to be taking away the market from the platform.

I'll weigh in on BSC.

It shows both EVM/Metamask network effects while also the strength and resiliency of the Binance brand.

Long-term very bullish for Ethereum, Binance, DeFi, and cryptoassets.

— Su Zhu (@zhusu) February 19, 2021

Binance Smart Chain has its shortcomings and many even complaints about it not being completely decentralized, however, the exchange’s reputation and its widespread reach for sure has made it the current choice of traders both the ETH and defi ones. However, many seasoned traders believe it is only a short terms solution, and if the Ethereum network manages to get the gas fee in control, traders would be back using the platform.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs