JPMorgan Predicts Bitcoin Rebound to $170K as Perp Market Selling Pressure Ends

Highlights

- JPMorgan analysts shared in a new research that Bitcoin could surge to $170,000

- They also shared that the worst of the perpetual futures liquidation phase has passed.

- JPMorgan’s valuation model shows Bitcoin trading far below its fair value when compared to gold’s market cap.

Analysts at JPMorgan have predicted that Bitcoin could surge as high as $170,000 in the next 6 to 12 months. This comes as the selling pressure in the Perpetual market is stabilizing.

JPMorgan Sees Bitcoin Rally as Derivatives Market Stabilizes

In the latest research, the firm’s strategist Nikolaos Panigirtzoglou and his team noted that the worst of the selling pressure in the coin’s perpetual futures market seems to be over. They also noticed that the open interest in BTC’s perpetual contracts has returned to normal.

The report emphasized that perpetual futures remain a major instrument to monitor for the current market cycle. “The message from recent stabilization is that deleveraging in perpetual futures is largely behind us,” the team wrote, signaling a possible shift from correction to accumulation.

The bank’s $170,000 target is based on a comparative model that puts the crypto on the same footing as gold. Bitcoin’s current valuation is significantly below its “fair value” when risk-adjusted against gold.

Their model presumes that the token requires about 1.8 times as much risk capital as gold. With private investment in gold totaling about $6.2 trillion, for the coin’s market capitalization to catch up, it would have to grow about two-thirds from its current $2.1 trillion. That increase would imply a price for BTC near $170,000.

“Bitcoin’s volatility-adjusted fair value is roughly $68,000 above its current level,” the analysts explained. They also added that this “mechanical exercise” suggests substantial upside potential within the next 6–12 months.

This latest projection comes after an earlier report from JPMorgan in October. They set the coin’s potential value at $165,000 back then.

JPMorgan Expands Institutional Access to Crypto

In a related development, JPMorgan announced plans to permit its institutional clients to use BTC and ETH as collateral for loans. The move follows a similar trend by other Wall Street firms such as BlackRock, Goldman Sachs, and Morgan Stanley.

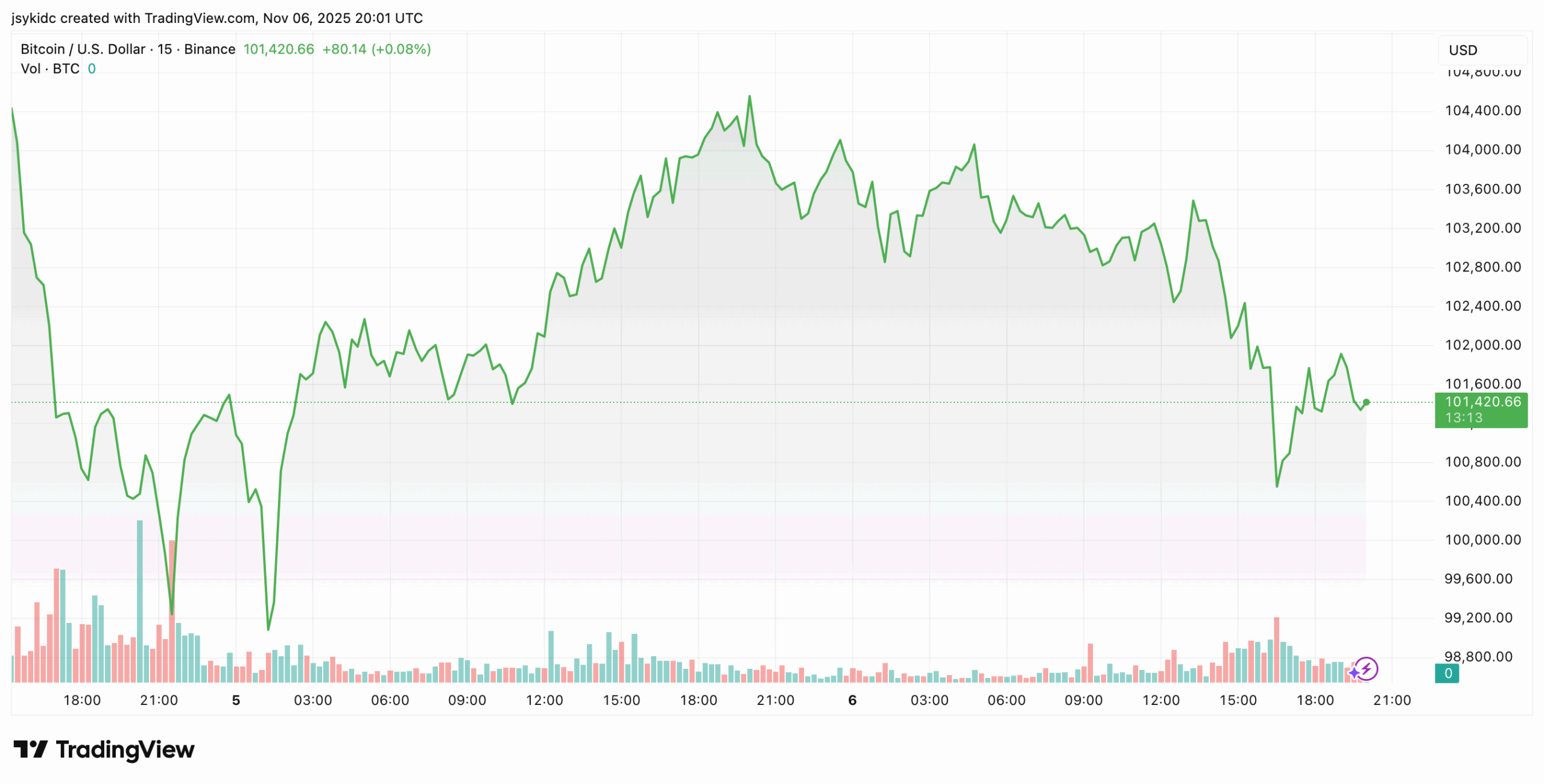

Yet, despite all of this bullishness, Bitcoin struggles to hold above $103,000 since the beginning of November, with over $2 billion of spot ETF outflows making for one of the longest redemption sprees in ETFs this year.

JPMorgan, however, insists that in perpetual futures, the sell-off phase is all but finished, which provides room for fresh buying momentum to kick in.

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card