Why Is Bitcoin Price Dropping Despite Higher Odds Of Fed Rate Cut?

Highlights

- Crypto traders brace for impact from crypto options expiry, CME BTC futures close, and PPI inflation data.

- Almost $1.4 billion in Bitcoin and Ethereum options expired on July 12.

- Traders sold positions on CME BTC futures as open interests fell by 1%.

- PPI inflation data comes in higher than last month.

The crypto market braces for the impact of crypto options expiry, CME BTC futures closure, and PPI data. Traders look for cues of market recovery as CPI inflation falls to a year low, anticipating Fed rate cuts to start in September. Let’s check details about reasons why Bitcoin price is dropping despite higher odds of a Fed rate cut in September.

Bitcoin And Ethereum Options Worth $1.4 Billion to Expire

Almost $1.4 billion in Bitcoin and Ethereum options expired on July 12, according to data from the largest crypto derivatives exchange Deribit. BTC price has dropped to a 24-hour low of $56,561, with not enough support from trading volumes for Bitcoin price recovery.

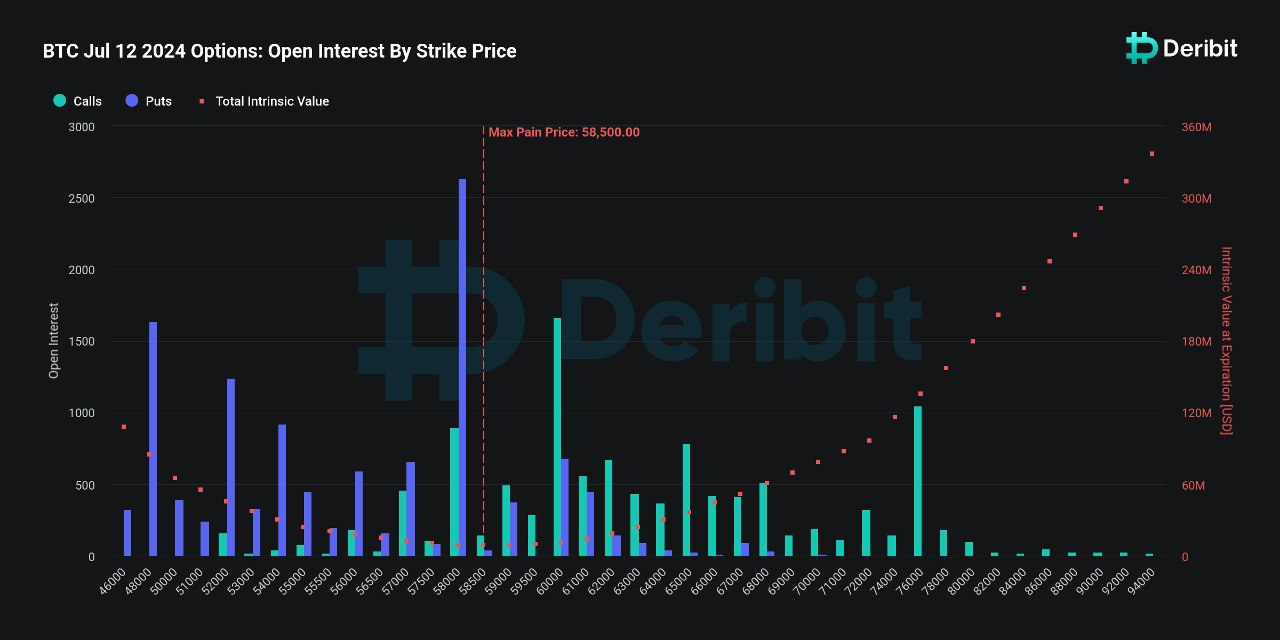

Over 23,722 BTC options with a notional value of $1.36 billion expired today on Deribit. The put-call ratio was extremely high at 1.08 as put open interests are 12,328.50 against 11,393.50 call open interests, raising skepticism over recovery in the coming days.

Moreover, the max pain was at $58,500 strike price, with put options more than call options at this strike price. Currently, the max pain point was higher than Bitcoin price of $57K. It indicates bearishness among traders continues to persist and Bitcoin remains under selling pressure.

Historical Volatility has continued to surge while BTC Volatility Index (DVOL) shows signs of drop. Options traders continue to remain cautious amid German government Bitcoin selloff.

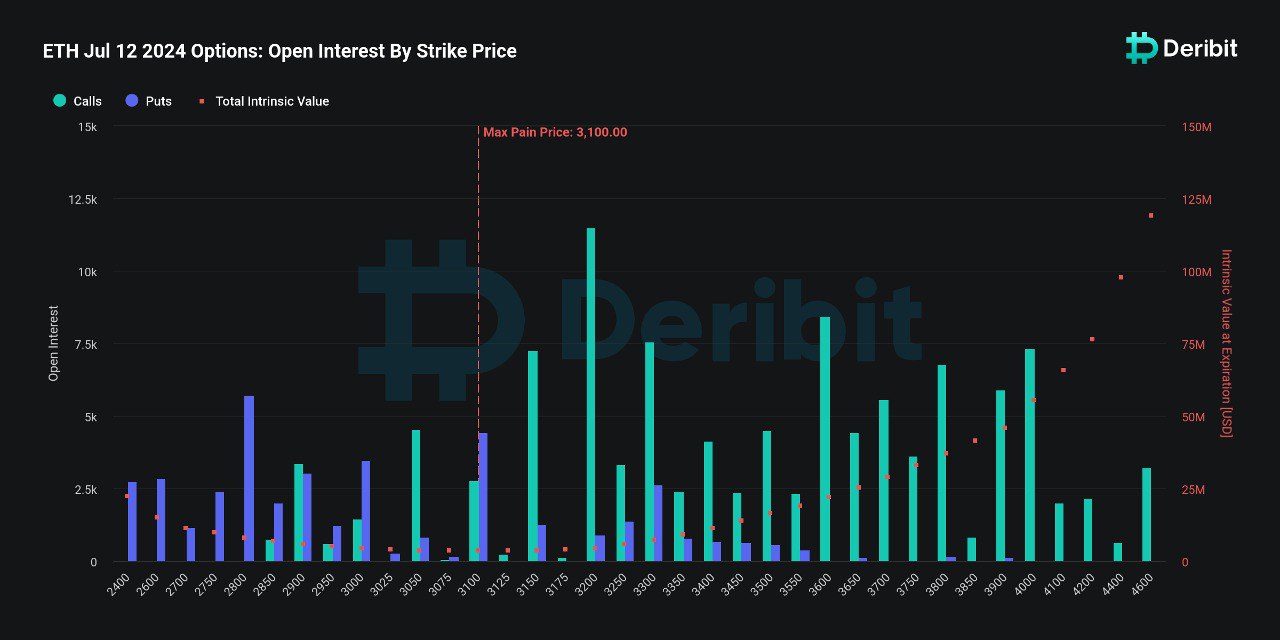

Meanwhile, ETH options of a notional value of $0.48 billion are set to expire. The put-call ratio is 0.37 and the max pain price is $3,100. ETH price is currently trading below the max pain point, implying that traders still have some room to recover amid the spot Ether ETF sentiment.

PPI Inflation Data Looms

Producer prices index (PPI) annual inflation data in the US come in hotter 2.6%, higher than 2.2% in May. The monthly reading also came in higher at 0.2% against -0.2% last month.

Meanwhile, Core PPI YoY for June is 3%, a 0.5% increase as compared to last month. Also, the Core PPI MoM also increased to 0.3%, higher than the previous month’s core PPI data. The latest data raised concerns among traders over the Fed rate cuts, turning them more cautious.

Recently, US CPI cooled to 3%, causing odds of Fed rate cuts to increase above 90%. Bitcoin also rebounded above $58,000 amid market optimism. However, the price has dropped amid negative sentiment.

Also Read: Crypto Market Crash Fails To Dent VanEck CEO’s Bullish Outlook

Bitcoin Price Falls As CME Futures Closes

Traders sold BTC futures as CME closed futures trading for the week, causing Bitcoin price to fall below $57,000. CME BTC futures trading will open on Sunday.

The crypto market rebounded slightly this week, with volatility falling sharply to a new low since March. The quarterly delivery and large fluctuations created a perfect entry opportunity for sellers. This week, option sellers opened large number of positions, which also became a driving force to lower the IV of major maturities.

Coinglass data indicates CME BTC futures open interest fell over 1% in the last 24 hours. The BTC futures OI has dropped to $8.26 billion.

Also Read: Bitcoin Enters Extreme Fear Zone For The First Time In 18 Months: Market To Crash?

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?