Why Is Crypto Market Down Today (Oct 14)

Highlights

- Renewed U.S.–China trade tensions spark a sharp downturn after an early October rally.

- China launches “special charges" in response to the U.S. tariff charges.

- Ethereum and Bitcoin ETFs see a combined $756 million in outflows as traders turn cautious.

October started out with the crypto market seeing impressive gains. However, the assets have encountered a downturn due to escalating trade war tensions between the United States and China.

Crypto Market Bleeds as U.S.–China Trade War Heats Up

The crypto market crash began shortly after President Trump announced a proposed 100% tariff on Chinese imports, effective November 1, 2025. The market recovered on the late hours of Sunday into Monday, but has since resumed its downturn.

On Tuesday, October 14, tensions deepened when China and the United States began imposing new port fees on each other’s shipping operations, extending the trade war to the transport sector.

Reuters reported that China confirmed it would collect “special charges” on U.S.-built, owned, or operated vessels, while exempting its domestic ships. The United States, in response, implemented tariffs on imported timber, furniture, and kitchen cabinets, most of which originate from China.

China’s Ministry of Commerce warned that it “will fight to the end if the U.S. wants a trade war,” but also left room for diplomacy: “If there’s a talk, the door remains open.” The statement did little to calm markets. Traders are bracing for prolonged economic friction between the two superpowers.

Market analyst Ted Pillows attributed today’s slump directly to Beijing’s response.

🇨🇳🇺🇸 China says it will "fight to the end" if US wants a trade war.

"If you wish to negotiate, our door remains open."

Today's dump is because of this.

Uncertainty. Trump needs to end this.

Clarity = pump.

— Ted (@TedPillows) October 14, 2025

Analysts noted that renewed U.S.–China hostilities had prompted large-scale profit-taking after early strong performances.

Fear Creeps Back Into the Market

The Fear & Greed Index for Bitcoin is now in the “Fear” zone, showing that investors are feeling anxious. Data from Glassnode indicates that funding rates in the derivatives markets are at their lowest since the bear market of 2022.

Meanwhile, Santiment analysts noted that the outcome of ongoing U.S.–China trade negotiations will likely determine whether the crypto market stabilizes or faces further downside.

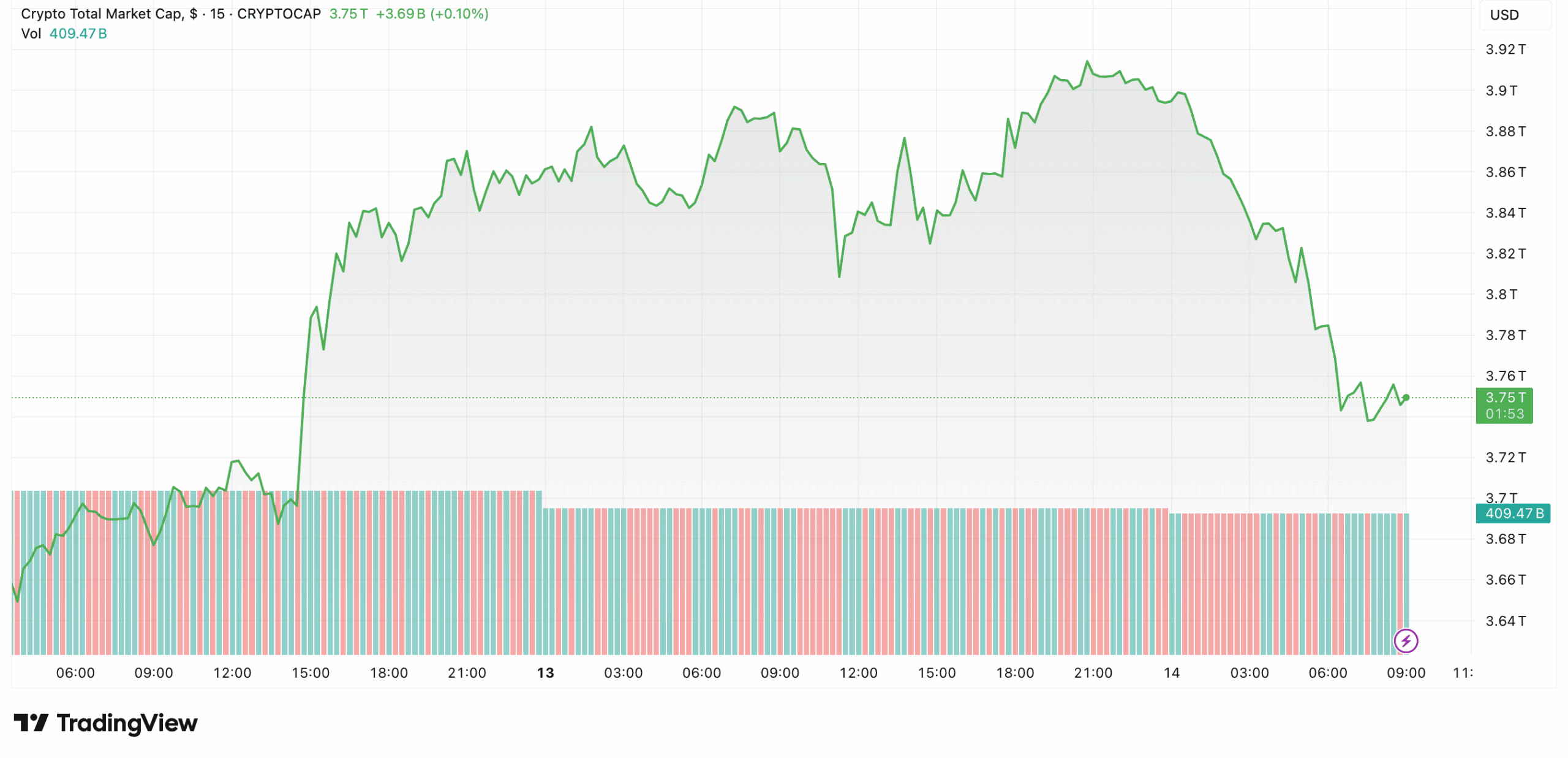

Over the course of a day, the crypto market cap dropped by almost 4% to $3.75 trillion. Ethereum has also suffered significant losses, and the Bitcoin price has fallen back to about $111,000.

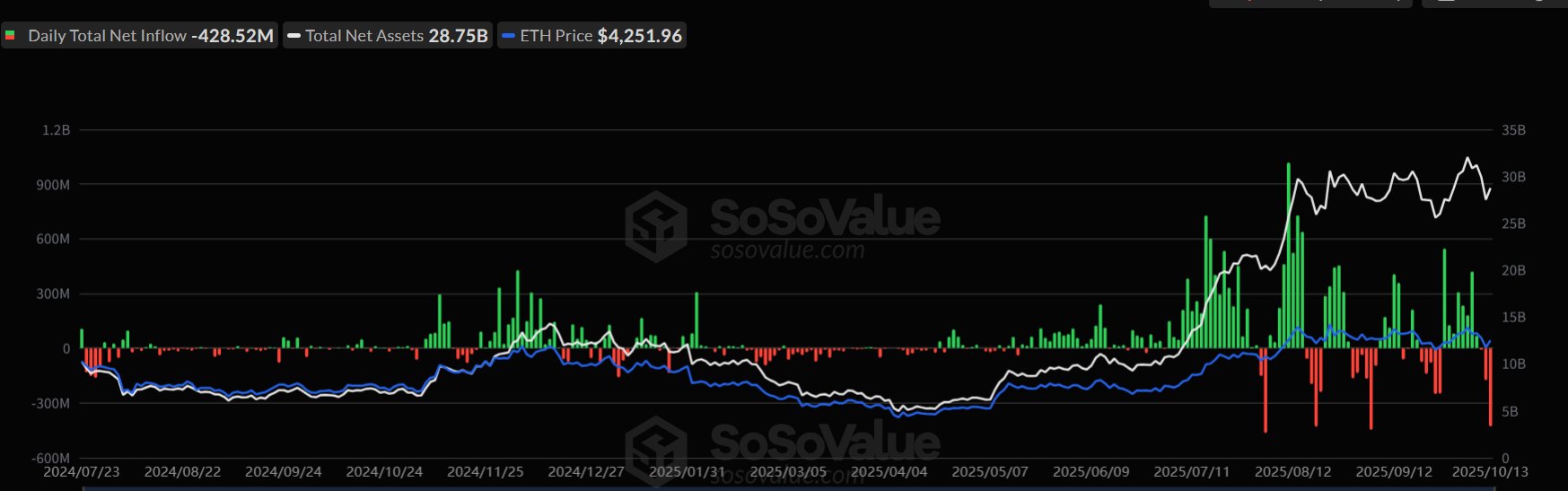

Adding to the bearish momentum, Ethereum spot ETFs recorded $429 million in net outflows on October 13, the third consecutive day of withdrawals. Bitcoin spot ETFs also saw a total of $327 million flowing out of the market.

Further fueling fear, a Trump Insider Whale, that shorted Bitcoin before last week’s market crash, has expanded their short position to $340 million. This same whale had previously shorted $700 million in BTC and $350 million in ETH. The trader made over $200 million in profit. Their renewed bets suggest that another price correction could be imminent.

Despite the sharp decline, some experts argue that the correction could be temporary. Usually, similar selloffs have presented buying opportunities once the dust settles.

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card