Why Is Crypto Market Up Today? (10 November)

Highlights

- Trump’s $400 billion tariff dividend sparks fresh liquidity, fueling strong crypto market recovery.

- U.S. Senate nears shutdown deal while CFTC advances regulated spot trading framework.

- Bitcoin tops $103,000 as Ethereum and Solana extend weekend gains amid renewed optimism.

The crypto market shot up today with big policy and regulatory actions in the U.S. boosted investor confidence and their liquidity expectations. Bitcoin climbed above $103,000. Solana price increased along with Ethereum and is continuing its weekend recovery due to positive macroeconomic and policy indicators.

Crypto Rally is Boosted with the $400 billion Tariff Dividend

The crypto market has surged since President Donald Trump announced a $2,000 tariff dividend to the majority of the American adults. The scheme will allocate more than $400 billion of tariff revenues. This generated hope throughout the risk assets. The action resembles previous stimulus check outs and is capable of providing a huge liquidity infusion into the crypto market economy.

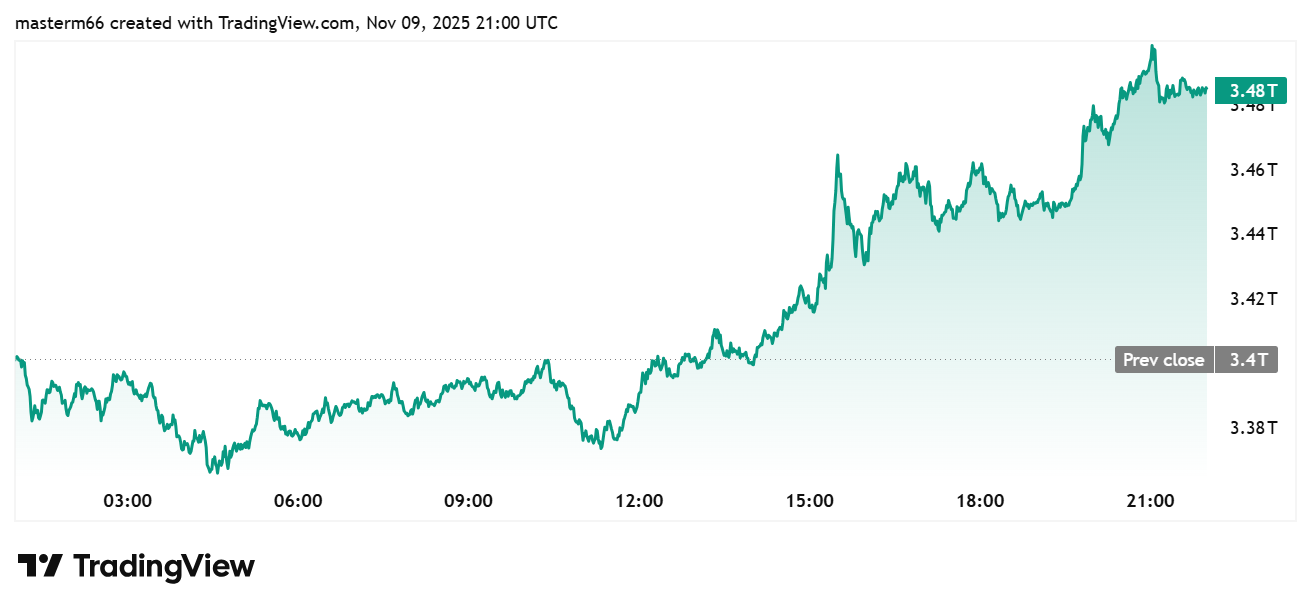

Bitcoin price jumped immediately after Trump’s Truth Social post, with Ethereum rising over 3% and XRP adding 2.3%. The total crypto market capitalization surged to $3.48 trillion, gaining 2.45% in 24 hours, as optimism spread across digital assets.

Data from TradingView shows that crypto market cap added $83 billion in a single day, marking one of the strongest sessions in November. Trump said the payments are possible due to trillions collected from tariffs and record investment in American manufacturing.

He emphasized that the initiative would exclude high-income earners and help pay down the $37 trillion federal debt. The Kobeissi Letter estimated that more than 85% of adults would qualify, calling it “another round of stimulus checks.”

Shutdown Deal and CFTC Push Strengthen Crypto Market Outlook

Adding to the positive sentiment, the U.S. Senate signaled progress toward ending the government shutdown. An Axios report stated that at least 10 Senate Democrats are prepared to advance a bipartisan spending package that could reopen the government through January. The deal includes provisions to reverse recent federal layoffs and extend Affordable Care Act tax credits.

The possible solution facilitated macro uncertainty. It also calmed investors that federal activities will resume once again. A convergence of liquidity optimism through tariff dividend and the possibility of a deal to end government shutdown have led to increasing inflows into crypto.

Meanwhile, the Commodity Futures Trading Commission’s acting chair, Caroline Pham, confirmed she is working to launch regulated spot crypto trading products. She said the plan will move forward without waiting for new legislation.

Pham said the CFTC is using existing authority to approve crypto exchanges for spot trading of the crypto market. This may start as early as December 2025.

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?