XRP News: Ripple Addresses Hit New ATH After Successful US ETF Launch

Highlights

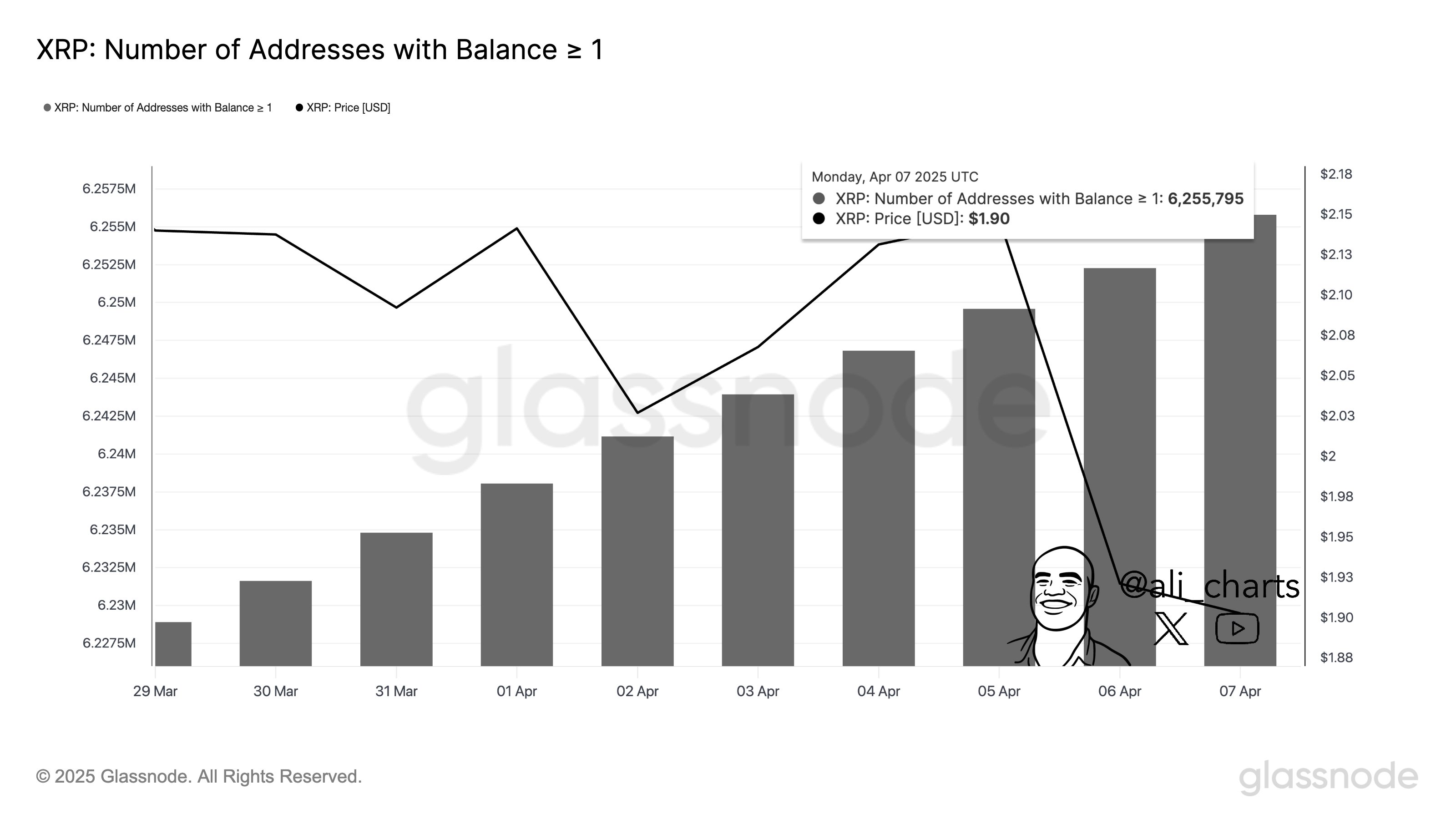

- Ripple addresses hit a record high of 6.26 million despite recent market volatility.

- XRP network growth indicates sustained investor confidence amid the market downturn.

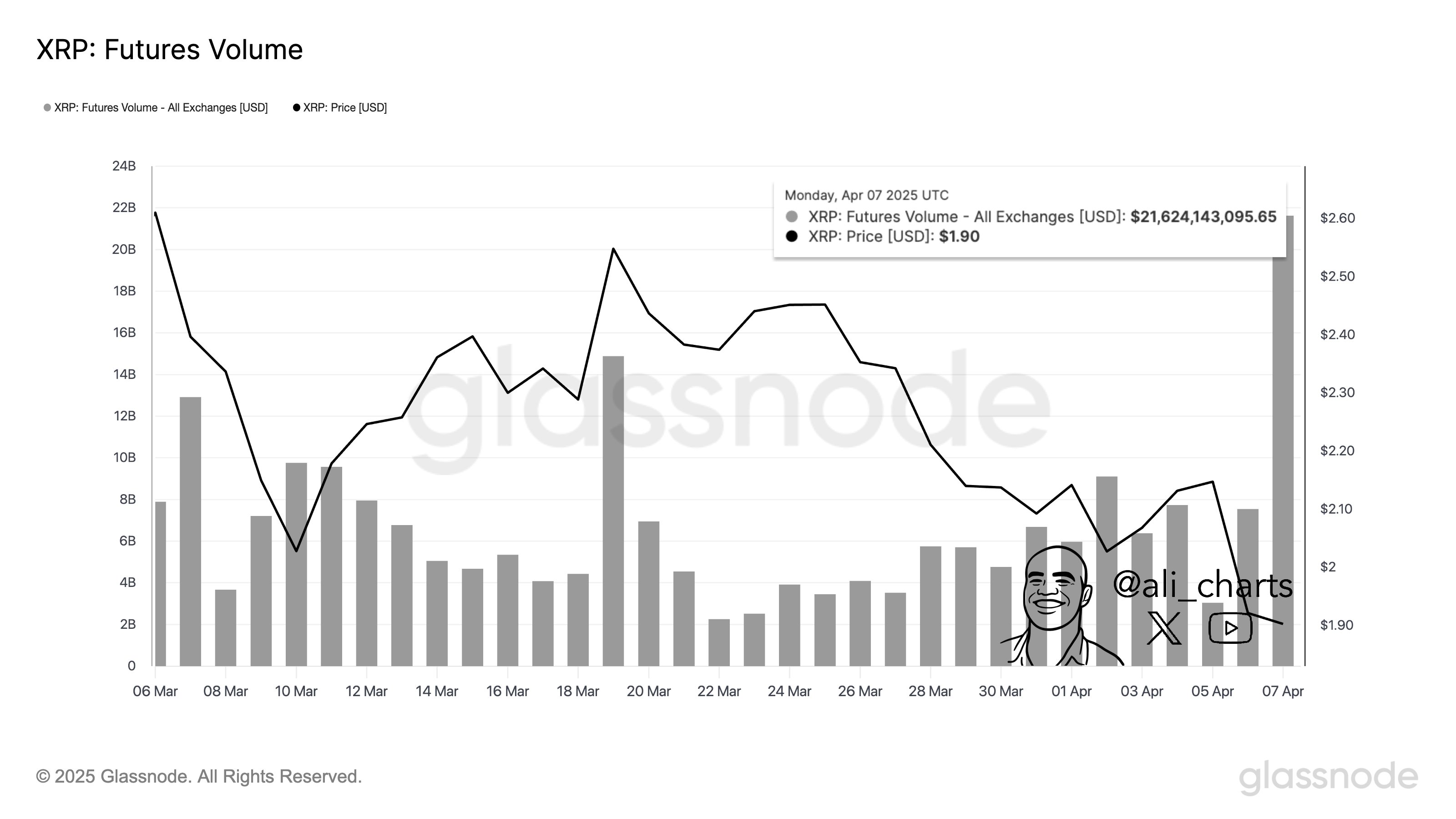

- XRP futures trading volume surged to a monthly peak of $21.62 billion.

- Successful US ETF launch boosts XRP sentiment, attracting institutional and retail investors.

In the latest XRP news, the Ripple holding addresses hit a record high, reaching more than 6 million despite the recent price crash. It indicates that despite the prices falling, the investors are still accumulating the token at a lower value. In other words, it appears that the investors are betting on the long-term trajectory of Ripple’s native asset, especially after the successful XRP ETF launch in the US.

XRP News: Investors’ Confidence Soars As Ripple Address Hit Record High

The investors are keeping close track of the XRP news, especially with a flurry of developments happening currently. Besides, the latest updates on the XRP lawsuit amid the ongoing market downturn scenario have further fueled market speculations.

Amid this, the XRP Network has shown a remarkable spike, indicating sustained investors’ confidence in the asset.

XRP Network Hits ATH

As said, Ripple’s XRP network is witnessing massive growth in user activity. Over 6.26 million addresses now hold at least one XRP, according to on-chain analyst Ali Martinez. This marks an all-time high for the network and signals strong investor conviction even during volatile market conditions.

Meanwhile, Martinez highlighted this rise in a recent post on X, stating the XRP network is growing “despite the recent volatility.” The data indicates that holders are accumulating XRP, seeing the dip as a buying opportunity. Many view the token as undervalued, especially in light of Ripple’s recent wins and expanding ecosystem.

On-Chain Data Signals Bullish Road Ahead

Adding to the bullish sentiment, Martinez also revealed that XRP futures trading volume has surged. It reached a monthly peak of $21.62 billion across all exchanges. This jump in trading activity signals rising interest from institutional and retail investors alike.

Simultaneously, the ETF launch appears to be a major catalyst.

XRP ETF Launch Boosts Sentiment

On its first day, the 2x leveraged XRP ETF (XXRP) recorded $5 million in volume. Bloomberg ETF analyst Eric Balchunas called the debut “very respectable,” especially given the tough market conditions. He noted the fund’s performance places it in the top 5% of all new ETF launches. Besides, it also outpaced Solana’s equivalent ETF, which launched recently but saw far less volume.

The recent ETF launch in the US has injected fresh optimism into the XRP market. While XRP’s price remains under pressure, the launch success shows growing institutional interest.

Balchunas emphasized that XRP’s debut volume was nearly four times higher than that of the 2x Solana ETF. This is notable, considering the broader market weakness and low retail sentiment. Although far behind Bitcoin’s ETF launch, the numbers signal that XRP is carving out its space in the ETF landscape.

However, despite the positive developments, XRP price today dipped nearly 9% and exchanged hands at $1.77. Besides, the XRP Futures Open Interest also fell 4% to $2.86 billion.

A recent XRP price analysis highlights three key reasons that might drive the Ripple price higher in the coming days. However, this upward trend would greatly depend on how the ongoing trade war between the US and other countries like China plays out. China has promised to battle Trump’s tariffs till the end unless both countries can reach a fair settlement.

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?