Bitcoin Bulls Move Past Key Resistance of $20,000; Binance and Other Exchanges Reported Down

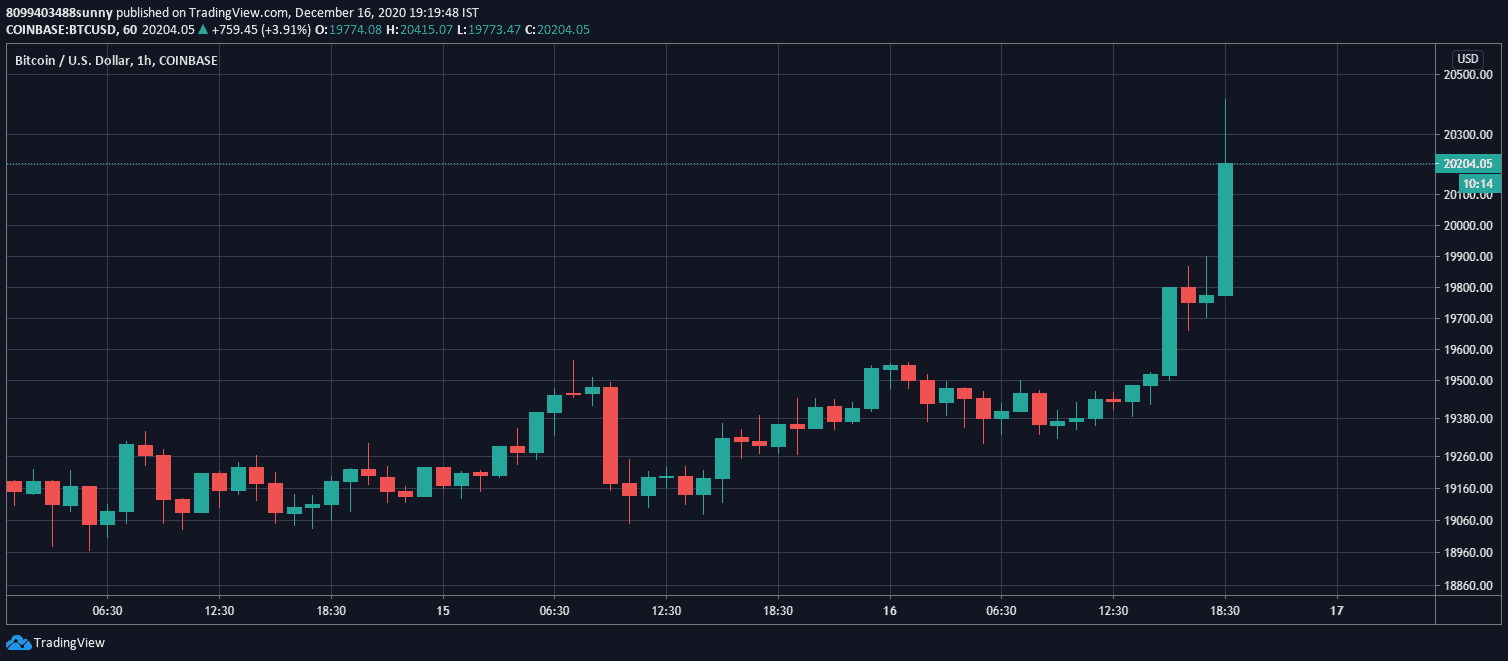

Bitcoin bulls have finally speared past the long-awaited $20,000 resistance just minutes ago after a mammoth rally of over $500 under an hour. Bitcoin with this massive rally also created a new all-time high of $ 20,643 seeing a 7% rise on the 24-hour price chart.

Bitcoin was consolidating above $19,000 for the past couple of days after recovering from a $3,000 crash pushing its price below $16,500. Howevr these market pullbacks are quite common during a bull run and bitcoin veterans seemed unphased by the drop.

The current rally could propel bitcoin to new price ranges and daily gains never seen before especially at a time when many believe Bitcoin is highly underpriced. The reason for that being high institutional interest where the firms such as MicroStrategy, GrayScale, Square Inc, and a few others are on a bitcoin buying spree over the past few months.

MicroStrategy went one step ahead and sold $650 million worth of Security debt to buy more bitcoin on top of their $500 million bitcoin purchase made earlier this year. MicroStrategy CEO Michael Saylor at the moment seems more bullish than most of the bitcoin proponent which is evident from his recent tweets.

Connect your phone to the mobile network, your computer to the data network, your home to the power network, & your treasury to the monetary network. #Bitcoin isn’t just an investment, it’s a way of life.

— Michael Saylor (@michael_saylor) December 15, 2020

What’s Next For Bitcoin, $23 k?

The current price rally could bring Christmas early for Bitcoin hodlers who have been predicting this all along. Bitcoin unlike 2017 is not yet priced-in and is showing a steady rise quite opposite of 2017. The bull run in 2017 started on December 17 and many crypto influencers have been calling it a poetic move if bitcoin managed to steer into new territory almost on the same day as the 2017 bull run.

The next stop for bitcoin would be $23 K as predicted by one crypto analyst who goes by the Twitter name of Goomba. With such a sharp rise, a price correction might be on the card, however, if the top cryptocurrency manages to hold its position above $20 K then the next target would be around $23,000.

$BTC to 23k

Broke out pic.twitter.com/UgJdFtHQlh

— Goomba (@im_goomba) December 16, 2020

The ongoing bull run was anticipated in the wake of institutional FOMO resulting in bitcoin hoardings by top financial firms such as BlackRock, Paypal, GrayScale, and Sqaure Inc.

Is Binance the new Coinbase?

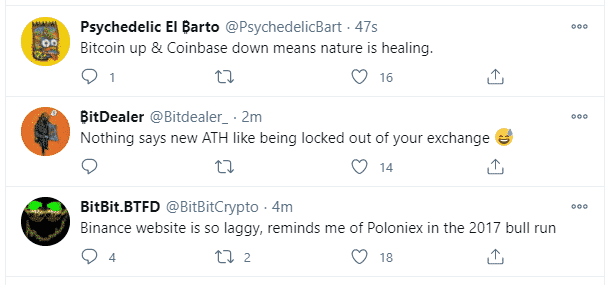

Binance seems to be the first causality among exchanges because of the sudden bitcoin price surge, on most occasions in the past Coinbase used to go under maintenance or become inaccessible. Many users complained about facing issues with logging into their Binance account.

anyone else having issues logging into binance?

— TraderSZ (@trader1sz) December 16, 2020

Coinbase as usual was dow too and people took to Twitter to express their distress but with a sense of humor. In fact, it is an ongoing joke in the crypto space that Coinbase going down has become a key indicator of bitcoin price rise.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs