Top Bitcoin Holding Company Stock Prices Are Down By More Than 15%, Buying Opportunity?

Many of the top Bitcoin-holding public companies are suffering significant drops in their stock prices to an amount that can interest several investors. For the past few days, the crypto market has been experiencing some intense selling pressure. The top cryptocurrency like Bitcoin(BTC) and Ethereum (ETH) have extended their correction phase and dropped by more than 10-15%.

-

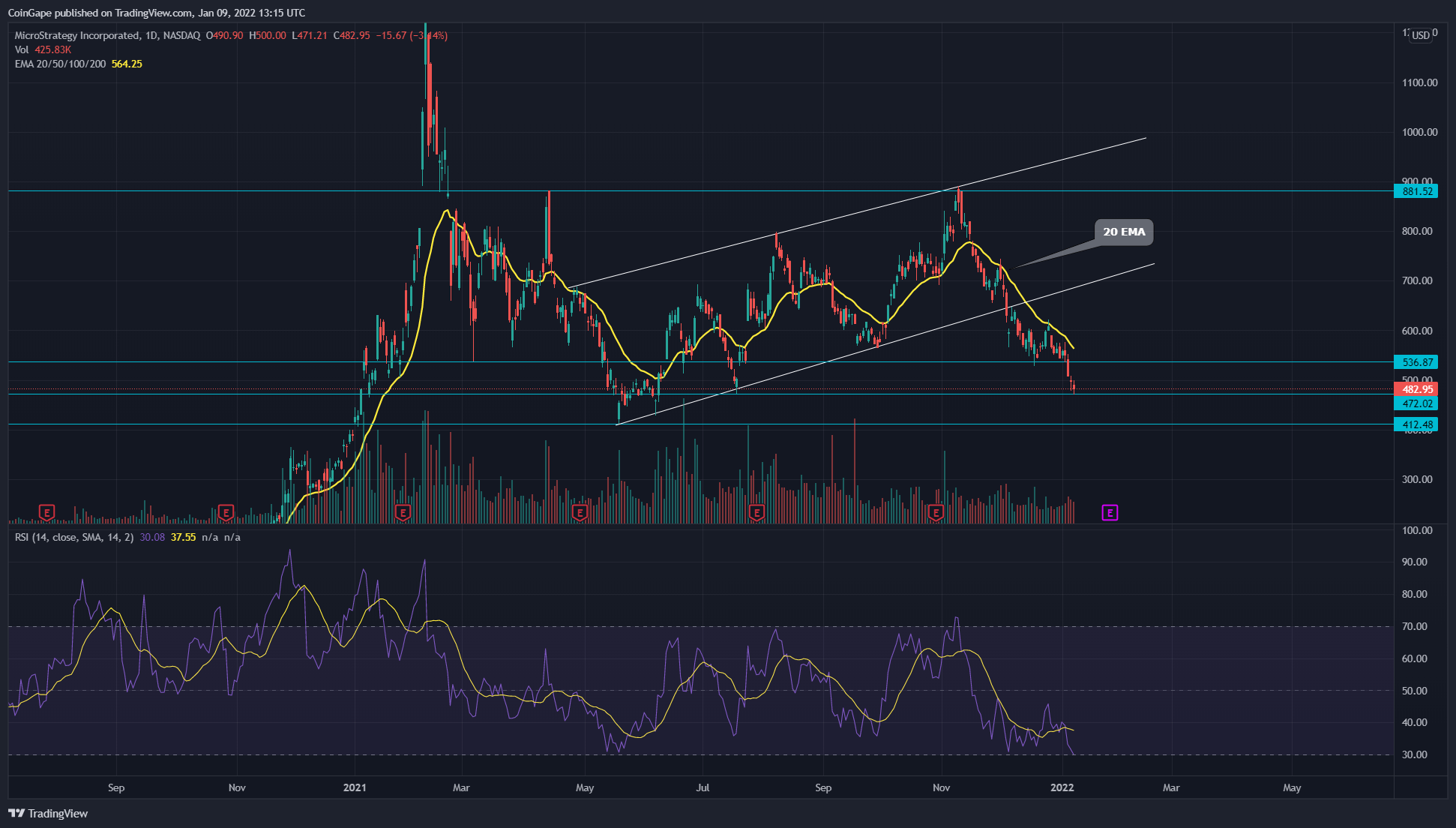

MicroStrategy ($MSTR) Price Escaping 20-day EMA Should Hint Bullish Reversal

Source- Tradingview

In the daily time frame chart, a parallel channel pattern was leading the recovery rally of MSTR share price. On December 3rd, 2021, the intense selling pressure in the price market triggered a bearish breakout, extending the correction phase for MSTR price.

The share price was discounted by more than 25% from the breakout point($642) and dropped to a minor support level of $482. Traders should look out for this support line and the lower one $412 that can provide sufficient support to the price.

The 20 EMA line is directing the bearish rally by providing dynamic resistance to the price. Therefore, the traders looking for a long opportunity should wait for the price to knock out this EMA line, providing the first sign of bullish reversal.

Moreover, the daily RSI chart(30) shows the sellers are losing their momentum.

MicroStrategy Inc. is currently holding a total of 121k Bitcoins, which is worth $5 Billion now.

-

Square ($SQ) RSI Chart Takes A Positive Turn In The Daily Chart

The Square share price resonated between $282.7 and $195.5 for most of the year 2021. However, on December 2nd, the price breached the bottom support level($195.5), initiating the bearish rally. The share price dropped more 27.81% and is currently hovering at the $140 support.

Contrary to the price action, the daily RSI shows a bullish divergence, indicating the buyers are trying to build up momentum.

In case the price manages to bounce back from $140 support or the $110 level. The traders should also wait for the price to break free from the 10-DMA line, acting as an excellent dynamic resistance.

Square Inc. is currently holding a total of 8027 Bitcoins, which is worth $333 Million now.

-

CoinBase ($COIN): Can the H&S pattern Lead To More Correction?

On November 10th, the COIN share price entered a retracement rally from the $363 mark. The price experienced significant supply pressure, plummeting its $472 support(-38.2%), in just two months. Coinbase officials were also recently reported by Coingape for dumping $COIN shares.

Moreover, the technical chart shows a head and shoulder pattern in the daily time frame chart. The pattern could increase more selling in the market if the price breaks down from the $215 support zone.

However, sustaining above this bottom support, the COIN price has a high possibility of reversal as the Stochastic RSI indicates bullish divergence, indicating the increasing strength of market buyers.

Coinbase is currently holding a total of 4483 Bitcoins, which is worth $186.7 Million now.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs