Bitcoin Price Analysis: Finding Bitcoin Bottom? Falling Prices Inside The Wedge Approach $40K

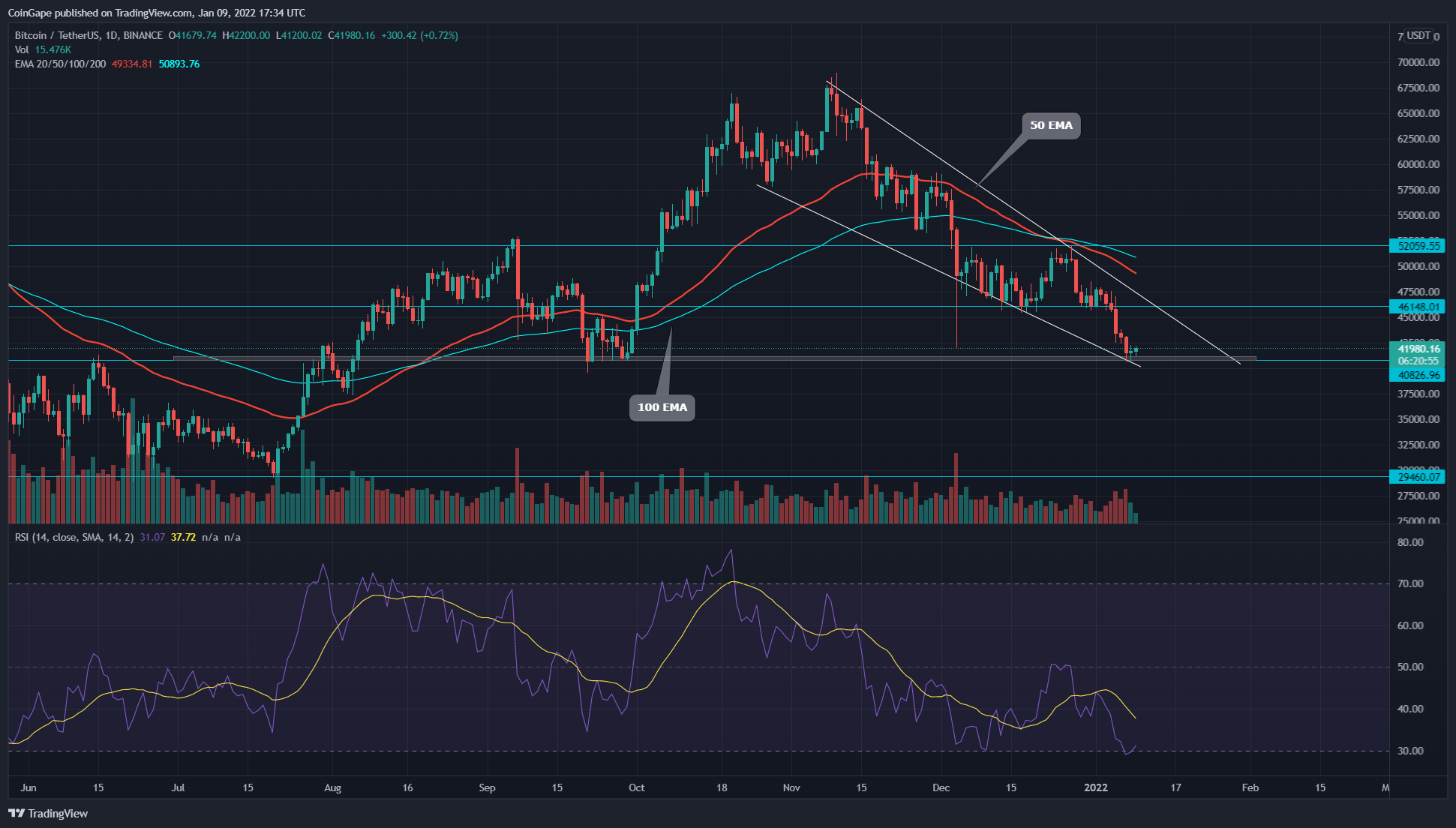

The Bitcoin price shows a tremendous rise in selling pressure as fear takes control of the crypto market. The price action forms a falling wedge pattern in the daily chart as it approaches the $40K mark with an 18% fall in the past two weeks from the resistance trendline. Moreover, the death cross increases the chance of a bearish continuation. Will the bulls overcome the selling pressure, or will the price hit the $35K mark?

Key technical points:

- The BTC coin price forms a falling wedge pattern

- The daily RSI chart shows a death cross in the daily chart

- The intraday trading volume in Bitcoin is $27 Billion, indicating a 35% loss.

Source-Tradingview

Source-Tradingview

The last time when we covered an article on BTC/USD, the coin price was teasing a bullish recovery from the $46K mark due to the bullish divergence in the RSI indicator. However, the increase in selling pressure results in the fallout of the $46K mark and drops the price lower to the $40K zone.

The price struggles to sustain near the $40K support zone and forms a falling wedge pattern in the daily chart. The price rests close to the support trendline and indicates a reversal if the bulls overcome the selling pressure.

The price fall of 18% in the past two weeks results in the death cross of 50 and 100 days EMA in the daily chart. Therefore, the coin price indicates a rise in underlying bearishness and hints at a fallout.

The daily Relative Strength Index (29) displays the oversold nature of the coin and shows the bearish move approaching saturation level. Therefore, a short-retracement is possible before a fallout.

BTC coin Price Near The Confluence Of Trendline And Support Zone At $40K

After the fallout of the $46K support level, the BTC coin price falls to the $40K mark with a 10% fall. Moreover, the coin price consolidates between the support zone and the breakout of which can decide the upcoming trend.

However, the bulls will have to overcome multiple selling areas to reinstate the uptrend.

Bitcoin fear and greed index

In the midst of ongoing sell-offs on the crypto market, the Bitcoin fear and greed index is now rated 23 out of 100, which indicates a extreme fear sentiment among market participants.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs